Financial technology has become one of the strongest forces reshaping the modern business landscape. From digital banking and mobile payments to AI-driven financial analytics, fintech has changed the way organizations handle money, manage data, and serve customers. However, simply adopting fintech tools is not enough. The true potential of fintech is unlocked when these systems are seamlessly integrated with existing business platforms such as enterprise resource planning (ERP), customer relationship management (CRM), or eCommerce systems. Fintech software integration helps businesses operate more efficiently, make smarter financial decisions, and deliver faster, safer, and more transparent services to their customers.

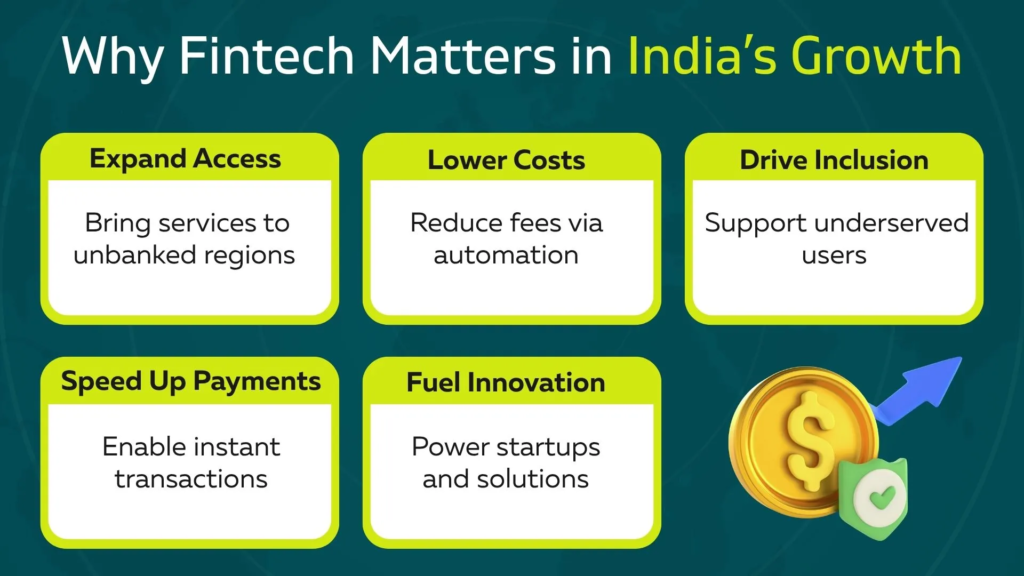

Why Fintech Integration Matters

The Hows: Implementing Fintech Integration

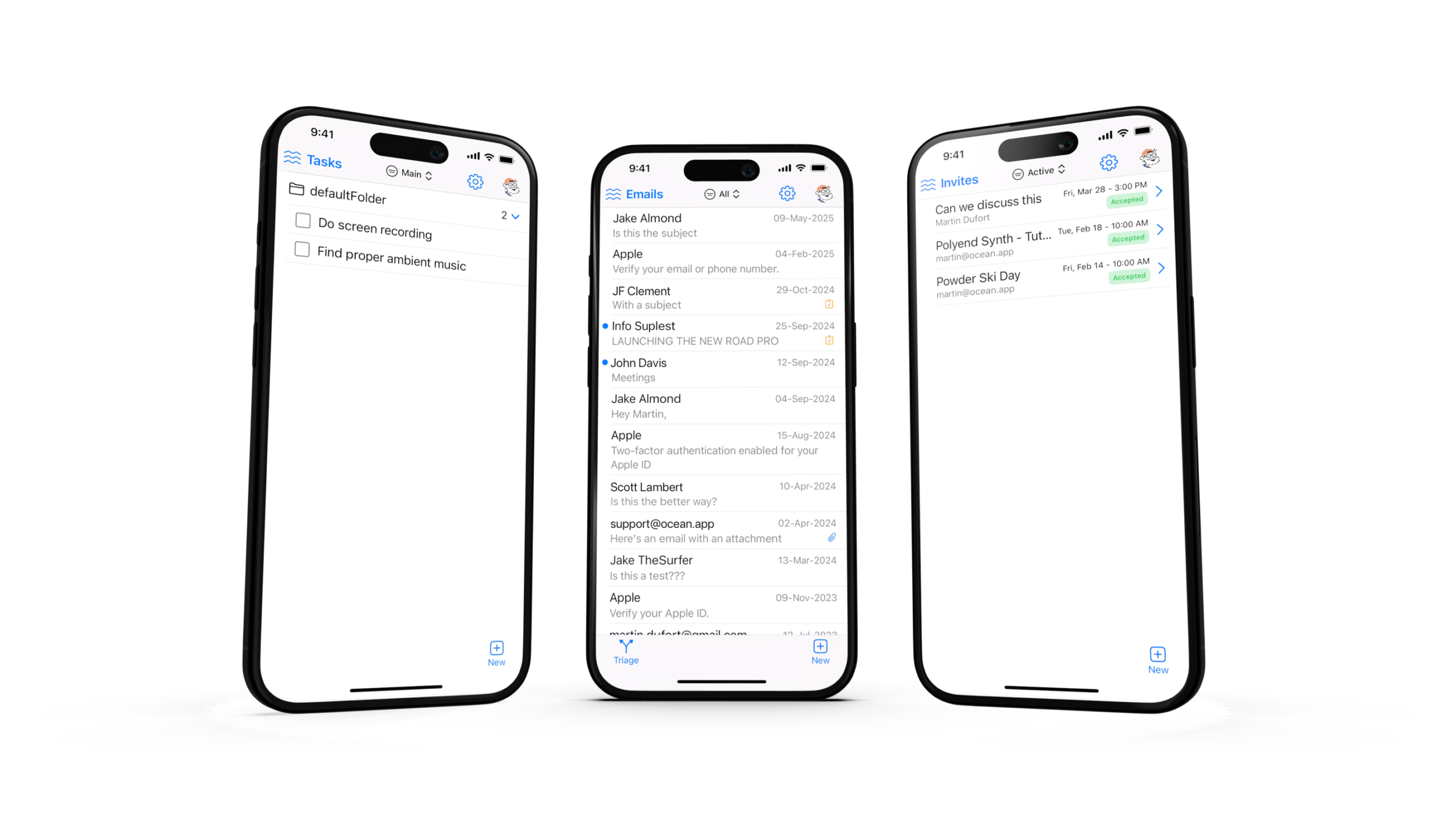

Implementing fintech integration begins with a clear understanding of your organization’s goals. Businesses should first assess their current systems and determine what kind of fintech solutions would bring the most value. Whether it is improving digital payments, automating accounting, or simplifying reconciliation, clarity at this stage ensures a smoother integration process later.

Once the objectives are defined, choosing the right fintech partner or API provider becomes essential. Compatibility with your existing systems, scalability for future needs, and adherence to strict security standards are all critical considerations. After selection, the technical phase involves connecting the systems through APIs, synchronizing data, and ensuring that every transaction is accurately recorded.

Comprehensive testing plays a vital role during this phase. It helps identify errors, improve performance, and ensure smooth communication between all integrated systems. Employee training is equally important because the success of any new technology depends on how effectively people use it. Regular updates and maintenance should follow integration to keep the software secure, compliant, and aligned with evolving business needs.

Common Challenges and How to Overcome Them

While fintech integration offers great advantages, it can also come with certain challenges. Data security is often the biggest concern, especially when sensitive financial information is being shared across platforms. Strict encryption standards and compliance with data protection regulations such as GDPR or PCI DSS are necessary to maintain trust and reliability.

Another challenge businesses face is the lack of compatibility between legacy systems and new fintech solutions. This can result in API mismatches or data synchronization issues. To address these, companies should work with experienced development teams that understand both traditional and modern system architectures. Scalability can also become an issue as transaction volumes increase, so the integration should be designed with future expansion in mind. Regular performance monitoring and system optimization help avoid bottlenecks and downtime.

The Future of Fintech Integration

The future of fintech integration looks incredibly promising. As financial technologies continue to evolve, businesses will find even more opportunities to connect and automate their operations. Open banking is already transforming how companies interact with banks, allowing them to securely access financial data and build new customer experiences. Artificial intelligence and machine learning are being used to predict market trends, detect fraud, and offer personalized financial advice.

Blockchain technology is creating new standards for security and transparency in transactions. Meanwhile, the concept of embedded finance is blurring the lines between financial and non-financial industries by allowing businesses to offer payment, lending, or insurance services directly within their platforms. These developments are setting the stage for a future where fintech integration is not just a technological improvement but a core driver of business innovation and growth.

Fintech software integration is no longer an optional step for modern businesses; it has become a strategic necessity. By connecting financial systems and automating processes, companies can enhance efficiency, reduce costs, and provide better customer experiences. Integrated fintech systems also ensure compliance, security, and scalability, which are crucial for long-term success in the digital era.

As the demand for digital transformation grows, organizations that invest in seamless fintech integration will be able to innovate faster and compete more effectively. At UXDLAB, we specialize in helping businesses design, build, and integrate fintech solutions tailored to their unique goals. Our expertise ensures that your financial operations are not only efficient but also future-ready, secure, and aligned with the ever-changing needs of your customers.

![Case Study: How We Helped [Client] Scale with a Custom Mobile App](https://uxdlab.com/wp-content/uploads/2025/08/case.png)